AI-Driven Algorithmic Trading

Discover how AI trading uses deep learning

Discover how AI trading uses deep learning

Explore how embedded finance and BaaS allow non-financial companies to offer seamless payments

Evaluate cybersecurity as a key investment metric.

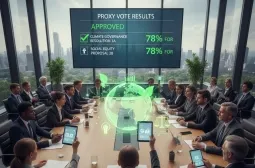

Learn how large asset managers use shareholder proposals to force ESG disclosure.

Explore SPACs as a capital raising alternative and private equity exit.

Explore Stablecoin regulation mechanics, reserve requirements, and the push for transparent asset backing to ensure payment stability

Explore the investment implications of supply chain reshoring driven by geopolitical risk.

Explore the growing market for Catastrophe Bonds (Cat Bonds) as an alternative risk transfer solution.

Explore Decentralized Science (DeSci) investment models,

Explore high-growth private space investment opportunities in the space economy

Navigate complex global crypto tax and NFT taxation.

Learn how liquidity pools, on-chain trading, and DeFi are challenging CEXs and mitigating slippage risk.

Learn why moving beyond black box models is essential for building trust in AI within finance.

Explore how advanced Robo-advisors use AI, behavioral nudges, automated asset allocation

Deep dive into Basel IV reforms, the finalization of Basel III, focusing on enhanced capital requirements, the Output Floor

Explore labor market trends and leisure economy growth.

how no-code ML platforms and AutoML are creating accessible tools, lowering entry barriers

Analyzing the shift away from a single global supply chain to regional economic zones

Explore the financialization of sports & entertainment, driven by private equity.

Learn how ML masters complex, multi-hop transaction monitoring, reduces SARs false positives, and ensures compliance.155