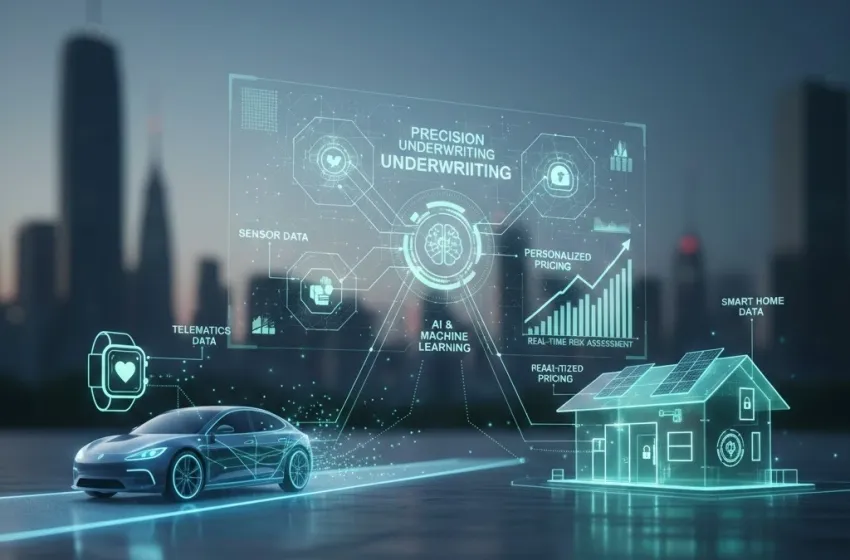

Discover how InsurTech uses telematics data, sensor data, and AI for precision underwriting.

Precision underwriting is the transformative approach within InsurTech that leverages vast, real-time data streams and advanced analytics—like machine learning (ML) and artificial intelligence (AI)—to achieve unprecedented accuracy in risk assessment and pricing. It marks a fundamental shift from the traditional model, which relied on historical averages and broad demographic segments, to a digital insurance paradigm focused on the personalized pricing of risk for an individual, often referred to as a "segment of one."

The Evolution from Traditional to Precision Underwriting

For decades, insurance underwriting was a manual, time-consuming process built upon a simple premise: grouping customers into large risk pools based on generalized attributes like age, location (ZIP code), and credit score. While this approach provided actuarial stability, it led to two primary inefficiencies:

- Cross-Subsidization: Low-risk customers often paid higher premiums than their actual risk deserved, subsidizing the claims of higher-risk customers. This led to churn among the most profitable clients.

- Inaccurate Pricing: High-risk customers were sometimes underpriced, leading to an erosion of insurer margins and higher overall loss ratios.

The rise of InsurTech—the technological innovation in the insurance sector—has catalyzed the shift to **precision underwriting**. This revolution is powered by the ubiquitous connectivity of the Internet of Things (IoT) and the ability to process "big data" in real time.

The Data Pillars of Precision Underwriting

Precision underwriting is fundamentally driven by the strategic collection, ingestion, and analysis of granular, **real-time data** from connected devices and external sources. These data streams provide a deep, contextual understanding of individual behavior and risk exposure that static data points could never achieve.

Telematics Data in Auto Insurance

The most mature application of real-time data is the use of **telematics data** in motor insurance, which enables Usage-Based Insurance (UBI). Telematics devices—either an installed "black box" or a smartphone application—collect minute-by-minute information about driving behavior.

Key Data Points and Their Impact on Risk Assessment:

- Acceleration and Braking Harshness: Aggressive driving (hard acceleration and braking) is strongly correlated with higher accident frequency, leading to an increased risk score. Safe, smooth drivers are rewarded with lower, **personalized pricing**.

- Speed and Cornering: Excessive speeding and forceful cornering indicate poor risk management on the road.

- Time of Day: Driving during high-risk periods, such as late at night, can increase the risk profile.

- Geospatial Data: Tracking routes and locations helps assess the intrinsic risk of the roads and neighborhoods regularly frequented by the driver.

By leveraging **telematics data**, insurers move away from pricing a driver based on what they *are* (e.g., a 30-year-old male) to pricing them based on what they *do* (e.g., a safe, low-mileage driver). This leads to an immediate and measurable reduction in loss ratios for the insurer and fairer premiums for the policyholder.

Health Wearables and Life Insurance

In life and health insurance, **sensor data** from health wearables (like smartwatches and fitness trackers) is ushering in a similar revolution. While this area requires careful navigation of privacy and regulation, the potential for accurate **risk assessment** is immense.

Real-Time Data from Health Wearables:

- Activity Levels: Consistent step counts and exercise frequency indicate a lower risk of chronic diseases.

- Sleep Patterns: High-quality, consistent sleep is a strong indicator of overall health.

- Heart Rate Variability (HRV): Advanced metrics like HRV can offer insights into stress levels and potential cardiovascular issues.

By voluntarily sharing this **sensor data**, policyholders demonstrate healthy, low-risk behavior, allowing the insurer to offer **personalized pricing** and incentives. This dynamic model shifts the insurer's role from a passive risk bearer to an active partner in promoting wellness, potentially reducing future claims.

Smart Homes and Property Insurance

The proliferation of **smart homes** and Internet of Things (IoT) devices is transforming property and casualty (P&C) insurance. **Sensor data** within a home provides real-time monitoring of high-risk events, enabling proactive intervention.

Examples of Smart Home Sensor Data:

- Water Leak Detectors: Sensors placed near water heaters, sinks, or washing machines can detect leaks instantly and shut off the main water supply, preventing costly water damage—one of the most frequent and expensive home claims.

- Smoke/CO Detectors: Connected alarms provide immediate alerts to both the homeowner and, often, a monitoring service.

- Smart Locks and Security Systems: Real-time data on the security status of the home (e.g., doors locked, system armed) can inform the theft risk.

- Environmental Sensors: Thermostats and environmental monitors can detect unusual temperature or humidity spikes that might indicate HVAC failure or mold risk.

Using this **sensor data**, insurers can apply sophisticated risk models to the individual property, going beyond generalized catastrophe (CAT) modeling for a specific ZIP code. This capability is at the core of **precision underwriting** in the property sector, enabling insurers to offer credits or discounts for demonstrably safer homes.

The InsurTech Engine: AI, Machine Learning, and Big Data

The sheer volume, velocity, and variety of **real-time data** streams require sophisticated technological infrastructure that is characteristic of **InsurTech**. AI and ML algorithms are the intelligence layer that transforms raw **telematics data** and **sensor data** into actionable insights for **precision underwriting**.

-

Data Ingestion and Normalization

The first step is for the **digital insurance** platform to ingest massive, continuous streams of data from disparate sources (vehicles, wearables, smart home hubs). This data must be cleaned, validated, and normalized to ensure quality before it can be fed into predictive models.

-

Predictive Modeling and Risk Assessment

AI and ML algorithms (such as Random Forests, Gradient Boosting, or Deep Neural Networks) are trained on millions of historical claims and enriched with real-time data. These models are capable of identifying subtle, non-linear correlations that a human actuary or traditional linear regression model would miss.

- Advanced Risk Segmentation: The AI creates highly granular risk segments—far beyond the traditional demographic segments—allowing for highly accurate **risk assessment**.

- Loss Frequency and Severity Prediction: The models predict not only the probability of a claim (frequency) but also the likely cost of that claim (severity), giving the insurer a true, comprehensive risk score.

-

Dynamic and Personalized Pricing

The final output of the analytical engine is a dynamic, hyper-accurate risk score that is directly translated into **personalized pricing**. This capability is often referred to as "dynamic pricing," where the premium can be recalibrated at policy renewal or, in some cases, continuously throughout the policy lifecycle, reflecting changes in the customer's behavior or environmental risk.

Benefits for Insurers and Customers

The adoption of **precision underwriting** offers compelling benefits that reshape the entire insurance value chain for both the provider and the client.

For the Insurer: Enhanced Profitability and Efficiency

- Lower Loss Ratios: By accurately identifying and pricing risk at a granular level, insurers can attract the best risks (safer drivers, healthier individuals) and avoid unknowingly subsidizing poor risks, leading to a healthier portfolio and reduced claims payouts.

- Operational Efficiency: Automated underwriting engines can achieve "straight-through processing" (STP) for simple policies, instantly processing quotes and approvals without human intervention. This frees up human underwriters to focus on complex, high-value cases.

- Competitive Advantage: The ability to offer immediate, fair, and personalized quotes based on **real-time data** provides a significant competitive edge in the crowded **digital insurance** market.

For the Customer: Fairness and Engagement

- Fairer Premiums: Customers who exhibit demonstrably low-risk behavior (safe driving, healthy habits) are rewarded with **personalized pricing** that reflects their actual exposure, not just group averages.

- Faster Experience: Quotes and policy issuance, particularly in **digital insurance**, can be delivered in minutes instead of weeks, greatly improving the customer experience.

- Risk Mitigation and Engagement: By providing behavioral feedback (e.g., "slow down on your commute," "your smoke detector battery is low"), the insurer helps the customer reduce their own risk, fostering a more collaborative relationship.

Challenges and the Future Outlook

While the technological capability for **precision underwriting** exists, its full-scale implementation faces several challenges:

- Data Privacy and Trust: The biggest hurdle is customer trust. Insurers must be transparent about what **sensor data** or **telematics data** is being collected, how it is used, and, crucially, how it is protected. Compliance with regulations like GDPR is mandatory.

- Legacy Systems: Many established insurers operate on decades-old, siloed IT infrastructure that struggles to ingest and process **real-time data** effectively. This requires significant investment in **InsurTech** platforms.

- Bias and Explainability (AI Ethics): The ML models used for **risk assessment** must be transparent and free of bias. Pricing must be based on genuine, risk-relevant factors and not on protected characteristics. The "black box" nature of some AI requires the use of explainability tools to ensure fairness and compliance.

The future of **digital insurance** is undeniably built on **precision underwriting**. As 5G connectivity expands and the cost of **sensor data** decreases, the use of **real-time data** from vehicles, health wearables, and smart homes will become the default for **personalized pricing**. This revolution promises a more efficient, equitable, and proactive insurance industry that benefits both businesses and consumers.